If you were in any doubt as to how difficult it is to afford to buy your own home, or how much this has changed over the years, this infographic makes the reality plain.

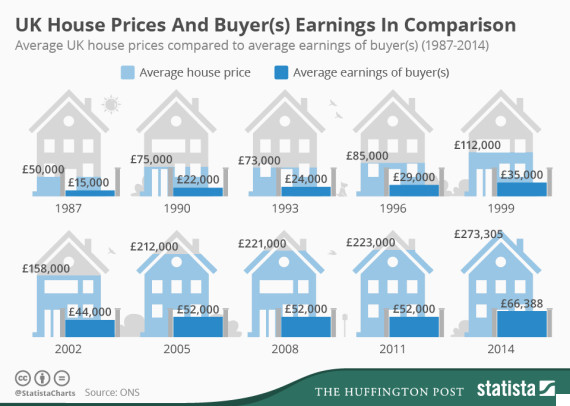

Using ONS data, we've plotted the average house price against the average income of the people who bought them, since the late 80s.

There was once an adage that buying a home would cost around three times your salary, and this really was roughly true for the people who bought houses 30 years ago.

In 1987, the average house price was £50,000 and the average income of someone who bought a home was £15,000 - only a little above average overall wage of around £13,000. You only had to be slightly more well-off than average to afford to own your own property.

Fast forward to 2014, and those days are gone.

House prices have gone up more than fivefold: the average home sold for £273,305 in 2014, and the average income of someone who bought one was £66,388. That's nearly three times today's average wage, which is around £26,000.

And because the average home is now over four times the average salary of those who can afford to buy, they could well be taking out larger mortgages, or relying on financial assistance from family to be able to buy, suggesting that people are becoming less and less able to buy a home without extra support.

It was recently revealed that there are just 43 affordable properties in the whole of London which could be bought by families earning a typical wage, according to research from housing charity Shelter.

That figure includes houseboats (selling for up to £165,000) and one mobile home (£125,000).

The analysis showed the 80% of homes in England are completely unaffordable for families, showing how distant the "dream of home ownership" - which politicians on all sides promise to restore - really is.

But there are solutions: If we improve private renting, fewer people would be so desperate to buy.

A roundtable debate for HuffPost UK brought together experts and commentators to discuss how we can encourage politicians to take action to improve life for people in the private rented sector - which houses 11 million people who are unlikely to ever be able to afford their own home.

Discussion led to a set of clear areas for the next government to urgently address:

- The need to rapidly accelerate Britain’s house building – both for private renting and social housing

- More funding for local councils to enforce regulations on landlords

- Better awareness and education for people who become landlords

- A strategy for the whole housing market – not just piecemeal offers

- More stability for vulnerable people in the private rented sector