BRITAIN’S housing market is like food in a microwave, says Spencer Dale, the chief economist at the Bank of England. It can “turn from lukewarm to scalding hot in a matter of a few economic seconds”. Since the crisis the bank has gained new tools to control the market’s temperature. Now that the heat is rising, it may soon start testing them out.

Until last year house prices were rising predominantly in prosperous central London boroughs. That was largely because of an influx of cash-rich buyers, says Neal Hudson of Savills, an estate agency. People saw posh property in the capital as a shelter from economic turmoil abroad. Elsewhere in Britain, the housing market was torpid. Potential buyers struggled to find mortgages. Falling real wages, economic uncertainty and the memory of plummeting house prices during the crisis curbed Britons’ obsession with property.

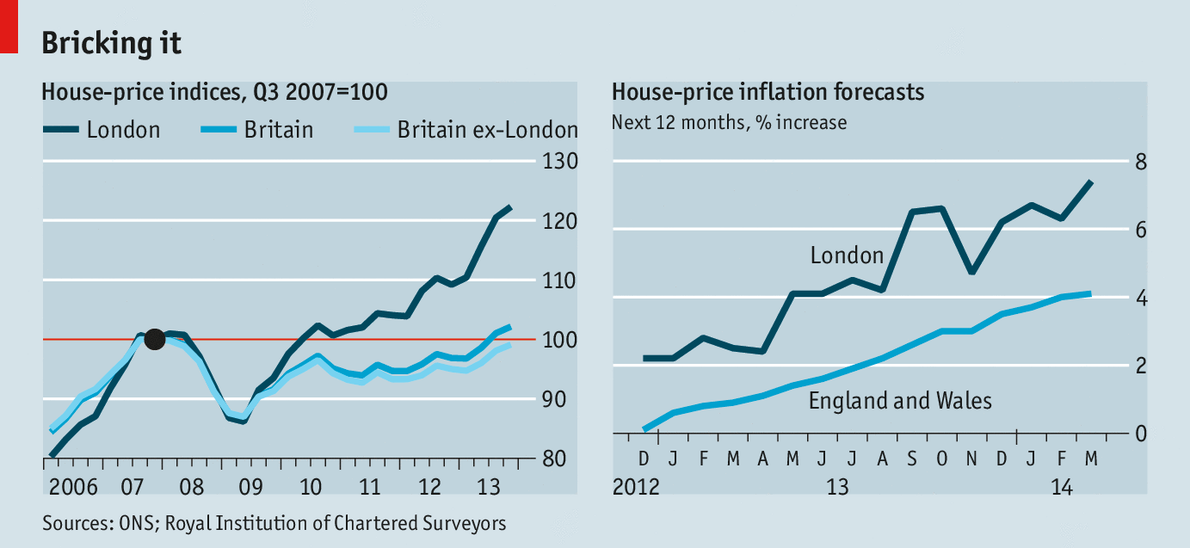

That changed in 2013. Prices rose by 6.8% in the year to January, according to the Office for National Statistics (see first chart). They are still increasing fastest in London—up 13.2% compared with last year—but the inflation has spread to outer boroughs. In Brent, an unfashionable part of north-west London, prices have risen 31% in a year, according to a report from Nationwide, a building society. It recorded chunky increases in every part of Britain.

These higher prices are a problem for first-time buyers, but they are not yet unsustainable. Nationally, house prices remain 16% below their pre-crisis peak, adjusted for inflation. Prices are high relative to wages, but that is not surprising. Successive governments have failed to free enough land for new housing developments, while doggedly preserving green belts. Borrowing costs have fallen over recent decades, in part because of a global glut of savings, making it easier for Britons to sustain large mortgages. Neither factor is likely to reverse any time soon.

Even so, the housing market is notoriously prone to bubbles. In January Mark Carney, the bank’s governor, warned MPs of the dangers of “extrapolative expectations”—people rushing to buy on the assumption that prices will continue to surge. Hints of that are visible. People increasingly think house prices will keep climbing (see second chart). Even though the government’s “Help to Buy” schemes, which subsidise higher-risk mortgages, are probably having only a moderate direct impact, publicity surrounding them has fed a broader conviction that prices can only go up.

Moreover, as borrowers chase higher prices their finances are becoming stretched. At the end of 2013, the average new loan for first-time buyers was 3.4 times the borrower’s income—the highest level on record. Barclays, a bank, currently offers mortgages as large as 5.5 times the borrower’s income. While interest rates are low, payments on such large loans are manageable. But when rates eventually rise, these borrowers could struggle. A wave of mortgage defaults, accompanied by falling house prices as banks try to sell repossessed houses, could cause yet another British banking crisis.

The Bank of England’s new Financial Policy Committee (FPC) says it is watching for “emerging vulnerabilities” in the market. Formed less than a year ago to confront threats to financial stability, including bubbles, its range of “macroprudential” tools aim to influence the behaviour of the financial system. Whereas politicians hope rising house prices will cheer voters ahead of next year’s general election, the committee can afford to take a longer view. With interest rates expected to remain low for a few more years, it is mulling what to do.

Dabbing the brakes

One approach is stricter vetting of borrowers. From April 26th banks will have to check that applicants have enough spare cash to cope if the Bank of England raises interest rates as markets expect (to around 3% in 2019). That is still a remarkably low standard. Future interest rates are uncertain; in past decades they have frequently exceeded 5%. The FPC has requested the power to impose tougher interest-rate tests, and will probably have it by the summer. That would allow it to curb the size of new loans, without increasing costs for existing borrowers.

An alternative is more vigorous stress tests of mortgage lenders themselves, using stringent scenarios that assume interest rates rise sharply while house prices fall. Forcing lenders to hold buffers large enough to withstand such a shock should deter them from offering the riskiest kinds of mortgage.

Kevin Daly, an economist at Goldman Sachs, an investment bank, thinks the FPC will enforce tougher affordability tests this year, possibly as soon as June. That would take some heat out of the market. It could also be unpopular. Poorer people would have to save for longer to buy a house. Wealthy home-owners would lose the comfort of swiftly rising prices. And George Osborne, the chancellor of the exchequer, would probably regret the cooling of a pre-election housing boomlet. But the FPC is independent for a reason. It should not fear to act.

www.economist.com