The 43 areas where homes cost £1 million

01-20-2014

New report shows how average house prices in England and Wales have broken through the £1 million barrier in 43 different areas

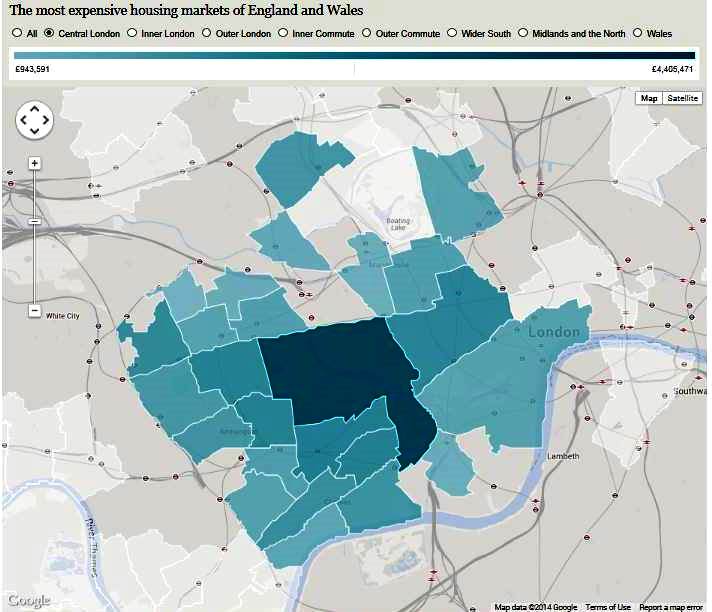

The most expensive housing markets of England and Wales

By Caroline McGhie, and Jasper Copping

Average house prices have surged beyond the £1 million mark in almost 50 areas of the country, with Britain’s economic recovery creating a new generation of property millionaires, a study shows.

The report, an authoritative analysis of sale values in England and Wales, identifies 43 locations where houses now sell for an average of more than £1 million, including several outside London.

It highlights how dozens of property hot spots have emerged not just in the South East, but also across the country, with average prices in areas of Buckinghamshire and Oxfordshire reaching more than £900,000.

In parts of Somerset, homes now sell for an average in excess of £800,000, while in several areas of the North and the Midlands, the average sale price is more than £500,000.

The report, compiled by estate agents Savills and analysts Property Database, also charts how house prices have risen over the past decade.

It found that in some areas the increase has been about 10 times the national average of 29.7 per cent.

The figures suggest that many areas of Britain are once again in the grip of a house price boom, which is helping to drive the country’s emergence from recession and encouraging forecasts of strong economic growth.

While some experts have expressed concern over whether the increases are sustainable, the data suggest that strong house price rises in the South East are dragging up values across the country, acting as an engine of wealth.

Yet there are also signs that the difficulties facing those trying to get on to the housing ladder may be easing. Other findings in the report include that:

• The most expensive area in the country is Knightsbridge and Belgravia, central London, where the average house price is now £4.4 million, after the biggest increase (342 per cent) in the past decade;

• 34 of the £1 million enclaves are also in the capital, with the other nine in commuter areas of Surrey, Buckinghamshire and Hertfordshire;

• Further afield, high-value clusters have emerged in rural parts of southern Oxfordshire, Winchester and other areas of rural Hampshire, as well as parts of cities including Bath, Oxford and Cambridge;

• One of the biggest price rises in the country was in the Brendon Hills area of Somerset, where the average house price has more than tripled in the past decade to pass £800,000;

• Five parts of the North and Midlands have average prices of more than £500,000, while in Wales, there are 20 areas with average prices of more than £300,000.

The report involved an analysis of Land Registry figures for house sales last year in 200 electoral wards across England and Wales.

Called The Most Expensive Housing Markets of England and Wales, it focused on the 25 most exclusive areas in eight distinct regions.

Lucian Cook, the head of research for Savills and the author of the report, said: “There are now very real magnets of wealth beyond the capital. A lot of areas have yet to feel the London ripple effect, so we expect to see them performing very strongly in the year ahead. We are already seeing this in the inner commuter ring. The affluent areas will be driving the recovery because transactions are much higher than elsewhere. Equity and wealth are leading the recovery and these are extreme examples.”

Experts argue that it shows how the property boom, which has been predominantly focused on the capital, is now being felt across the country.

While some of the resurgent property hot spots have been created, in part, by buyers selling houses at high prices in London and taking their property capital with them into commuting areas, others are far further afield and are interpreted as signs of economic growth well beyond the South East.

Areas in Cornwall, Cumbria and Pembrokeshire have all seen prices double in the past decade.

Mr Cook said that such clusters could help to accelerate economic growth in neighbouring areas.

“Wealth attracts wealth and in difficult times people want good schools, they want to maintain close family links and go where their friends are,” he said.

“It becomes self-perpetuating. Some areas have seen phenomenal growth in the last five years during the recession. In a lot of them it is because houses at £2 million or more have continued to sell, and this has pushed the figures upwards.”

Much of the criticism of the housing market has been that it has become difficult for young and first-time buyers to get on the ladder.

In today’s Business section, Nigel Wilson, the chief executive of Legal & General, the insurance and investment group, warns that the Government should abandon its Help to Buy scheme in London, as it risks stoking a price bubble that will put homes out of reach for all but the most affluent.

However, evidence suggests the policy is making it easier for those at the bottom of the property ladder. Brian Murphy, the head of lending at the Mortgage Advice Bureau, said: “The latest lending figures are yet to reveal the full impact of 95 per cent Help to Buy mortgages on first-time buyer numbers, but, as over 6,000 applications were received in the last three months of the year, we’re sure to see this market move in the right direction. Further growth is a certainty, especially as the mix of lenders offering these mortgages is growing almost week by week.”

However, there are concerns over the shortage of houses for sale. Tomorrow, the National Association of Estate Agents is to publish a report saying that many agents are finding that numbers of houses for sale are between 25 per cent and 80 per cent down on this time last year. Mark Hayward, the managing director of the National Association of Estate Agents, said: “This means there isn’t much to buy. It keeps transaction levels down and pushes prices up.”

Richard Donnell, the director of research at property analysts Hometrack, said: “The top end is moving, but for people further down the ladder it is all about interest rates, income levels and the ability to take on debt. Figures from Tesco and Sainsbury’s tell us that people are still feeling very pinched.”

The Government has kept interest rates historically low at 0.5 per cent for five years, in an attempt to keep the market stable. To further enhance stability, it emerged last week that the Bank of England might introduce longer fixed-rate mortgages — of 30 years or more — along the lines of the Japanese or American models.

The Office of Budget Responsibility predicts house prices will rise by 27 per cent by 2018, considerably more than the 15 per cent rise it was predicting at the end of last year, showing an increased belief that the buoyancy is here to stay. Such an increase might lift dozens more areas into the £1 million league by the end of the decade.

Among those who believe the recovery is becoming sustainable is Martin Ellis, the chief economist at Halifax.

“Mounting signs that the economic recovery is becoming firmly established, together with a predicted decline in unemployment, should further boost consumer confidence over the coming months,” he said.

“This will increase the likelihood that more people will consider buying a property in 2014, therefore supporting the housing market.”

So great is interest in some of the hot spot areas that Strutt and Parker estate agents in Winchester estimate that there are 700 potential buyers on a waiting list, with a total of £864 million to spend.

Zoopla records that house prices rose by an average £34,216 in the city last year.