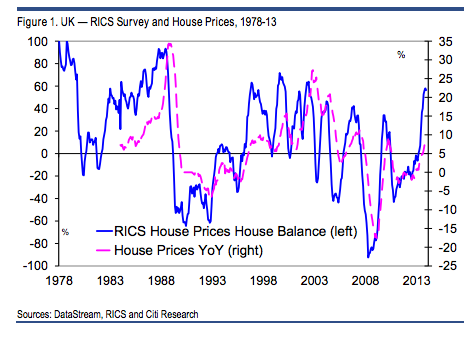

The latest RICS survey shows that house prices are continuing to boom in the UK.

This is despite the fact that the net balance of surveyors reporting house price gains edged down from 58 per cent in November 2013, which was the highest since 2002, to 56 per cent in December. As Citiís Michael Saunders notes the overall rate remains very high and consistent with house price gains of at least 10-15 per cent year-on-year, especially since the reading for house price expectations is the highest since 1999.

Whatís more interesting, however, is that the boom is no longer as London/South-East centric as it has been.

As Saunders noted on Thursday (our emphasis):

The split shows house prices rising particularly strongly in London and the South East, but prices are rising across all regions of the country. Price expectations are at a record high in the East Midlands and the latest figure is the second-highest ever for South West England and the third-highest for North West England. The latest readings for expected sales are among the highest three ever recorded in East Anglia, Wales, South West England, West Midlands, East Midlands and Scotland. The housing boom is not just a central London phenomenon, it is broad-based across the UK.

Which either means that the great London exodus has begun in earnest, or that the trickle down out-of-London effect is finally gaining some major momentum.